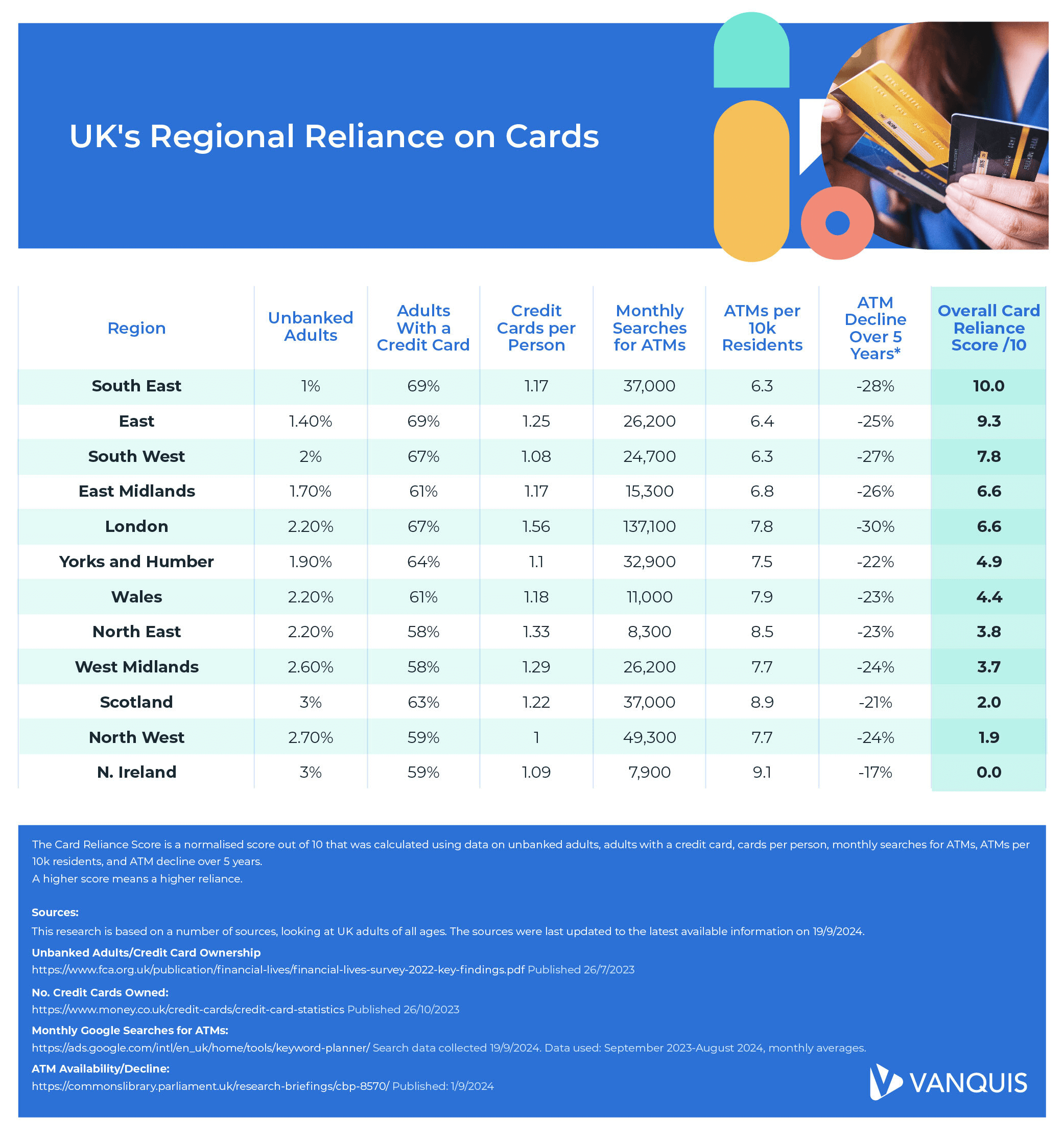

So, with more of us now going cashless, we wanted to highlight the regions using credit and debit cards the most. In this study, we also looked at ATM demand and availability, credit card ownership and the percentage of adults with bank accounts.

With only 10% of UK adults still preferring to pay by cash, it’s clear digital payments are becoming the norm. But which areas lead the way?

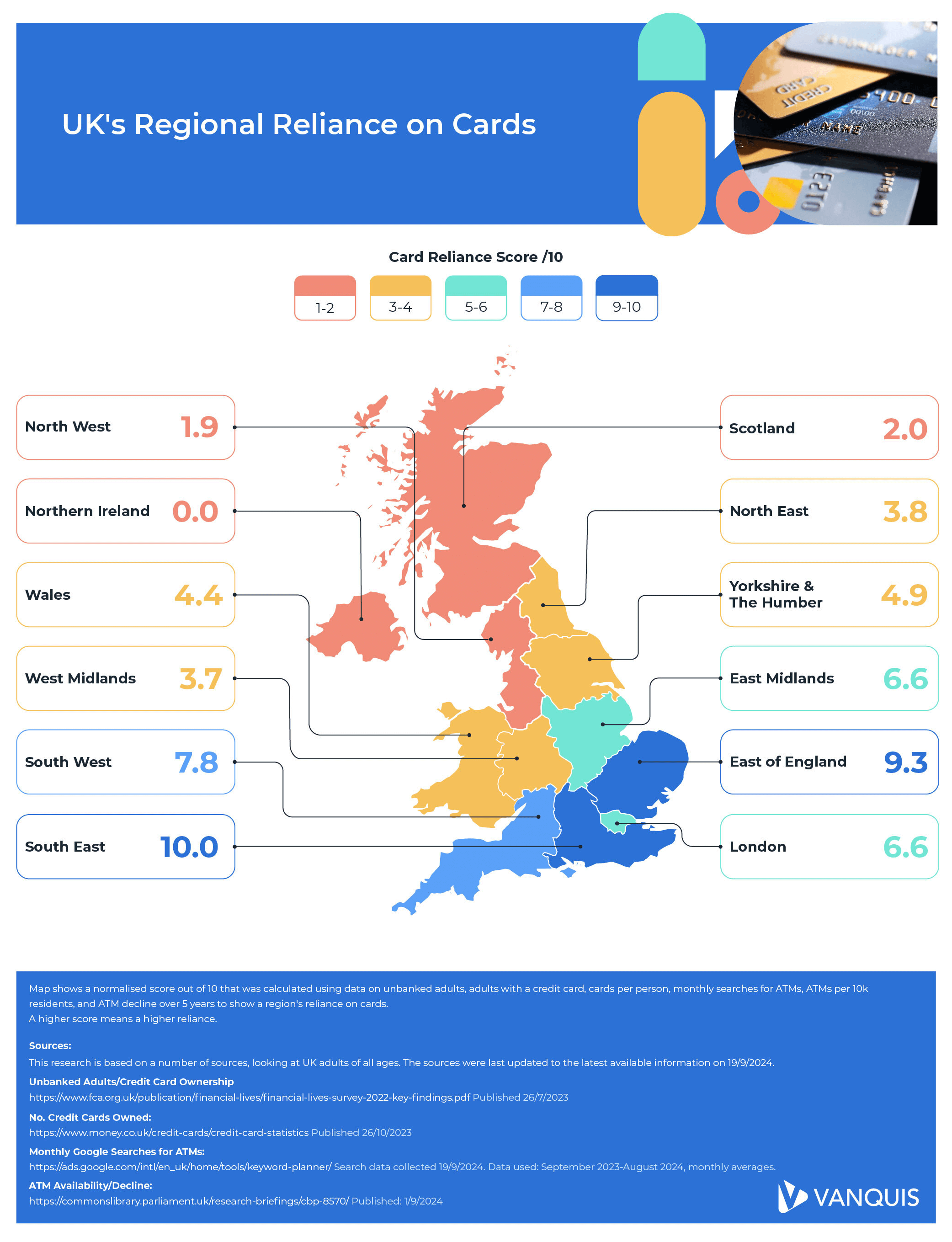

According to the data, the South East tops the list, closely followed by the East of England and the South West.

The South East leading the cashless revolution

Home to cities like Brighton, Oxford and Southampton, based on this research the South East is the UK’s most card-reliant region. Only 1% of the population studied is unbanked (those with no access to traditional financial services) and 69% of adults in this study own credit cards. So, it’s no surprise this area tops the charts on card usage.

Interestingly, the South East has one of the lowest ATM availabilities, with just 6.3 cash machines per 10,000 people living there. In fact, the number of ATMs has gone down by 28% over the last five years*. There's still a demand for them though, with over 37,000 monthly (accurate as of September 2024) Google searches for nearby cash machines. High card ownership and less cash access reflects the region’s shift to digital payments.

The East of England - a close 2nd

The East of England takes the silver medal position when it comes to card dependence. Like the South East, just over 1% of the adult population studied is unbanked and 69% own a credit card. The area - which includes cities like Cambridge and Norwich - also ranks high for credit cards, with an average of 1.25 cards per adult.

Although the region shows a strong preference for card payments, there are still a significant number of Google searches for ATMs, with 26,200 per month. (Accurate as of September 2024.) Cash machine availability remains low though, with only 6.4 per 10,000 residents - the second lowest in the UK.

The South West – a rising reliance on debit and credit cards

The South West, with Bristol and the popular holiday county of Cornwall within its borders, takes third spot on the list. While 67% of adults studied in this area own credit cards, the average of 1.08 cards per person is a tad lower than in other areas.

ATM availability is the joint lowest in the UK, with only 6.3 per 10,000 people. There's been a 27% decrease in this number over the past five years - further proof of the area’s growing preference for cashless payments.

What about the other regions?

Rounding out the top five are the East Midlands and London. The East Midlands has a slightly higher unbanked rate of 1.7% but credit card ownership is down at 61%. Meanwhile, in the capital, there’s an average of 1.56 credit cards per person - potentially due to the high living costs.

Despite the reliance on cards, London also sees the highest demand for ATMs, with 137,100 monthly searches. (Accurate as of September 2024.) This may be down to the large population, tourist traffic and a 30% drop in cash machine availability.

To sum it all up...

This study shows a clear shift toward cashless payments across the UK, especially in areas with fewer ATMs and high credit card ownership. As the UK goes more digital, regional payment trends give us valuable insights.

Debit and credit cards make spending easy, secure, and trackable - but it’s important to keep cash as an option, especially for the older generation who still like using it.